Incentive schemes granted by the new program can be applied by a real person of foreign nationality through a joint-stock or limited liability company, and by a foreign company based in foreign countries through a joint-stock, limited liability company or a branch established in Turkey.

Value Added Tax (VAT) Exemption

Customs Duty Exemption

Tax Deduction

Social Security Premium (SSP) Support for Employer's Share

Land Allocation

VAT Refund

Only VAT and Custom Duty exemptions are applicable in this type of incentive.

There are two requirements to benefit from this incentive mechanism in Istanbul, which

Vat Exemption, Customs Duty Exemption, Tax Reduction, Social Security Premium Support, and Land Allocation are available in Regional Investment Incentive Scheme. The regional system aims to eliminate inter-regional imbalances by means of encouraging pre-determined sectors. Therefore, investment topics to be supported have been identified by taking into consideration the economic potentials of each province and economies of scale. Through the new regime, 81 provinces of Turkey are classified under 6 investment regions. Istanbul, which is the most developed region of Turkey, is classified in the 1st-degree regional list.

| Incentives Instruments | Istanbul (Region 1) |

| VAT Exemption | Available |

| Customs Duty Exemption | Available |

| Tax Reduction (Rate of Contribution to Investment %) | 50% (out of OIZ Rate of Contribution to Investment %15) 55% (in OIZ Rate of Contribution to Investment %20) |

| Social Security Premium Support (Employer’s Share) | 2 years (out of OIZ) 3 years (in OIZ) |

| Land Allocation | Available |

Sectors below are able to benefit from Vat Exemption, Customs Duty Exemption, Tax Reduction, Social Security Premium Support

|

Sectoral Code |

Investment Topics |

Minimum Amount of Investment /Capacity |

|

1911 |

Leather Tanning, Processing (Only in Istanbul Deri İhtisas OIZ and Tuzla OIZ) |

TRY1 million |

|

2423 |

Medicine and Pharmaceuticals |

TRY1 million |

|

2929 |

Industrial Patterns |

TRY4 million |

|

30 |

Office, Accounting and IT Processing Machines |

TRY1 million |

|

32 |

Radio, TV, Communication Equipment and Devices |

TRY1 million |

|

33 |

Medical Devices, Sensitive and Optic Devices |

TRY1 million |

|

5510.3.01 |

Dormitories |

min.100 students |

|

80 (809 Excluded) |

Education (Schools, Universities) |

TRY1 million |

|

8511.0.01-05 |

Hospitals, Nursing Home |

Hospital: TRY1 million Nursing Home: min.100 persons |

|

8511.0.99 |

||

|

8531.0.01-03 |

||

|

- |

Waste Management and Recycling Facilities |

TRY1 million |

In addition, investments in the following sectors will be treated as if they are realized in a 5th-degree region regardless of its actual destination.

Vat Exemption, Customs Duty Exemption, Tax Reduction, Social Security Premium Support, and Land Allocation are available in Regional Investment Incentive Scheme. The goals of this scheme are to improve technological and R&D capacity of regions and to provide a competitive advantage in the global arena. The listed investment topics that exceed the designated minimum amounts are eligible in Istanbul.

| Incentives Instruments | Istanbul (Region 1) |

| VAT Exemption | Available |

| Customs Duty Exemption | Available |

| Tax Reduction (Rate of Contribution to Investment %) | 50% (out of OIZ Rate of Contribution to Investment %15) 55% (in OIZ Rate of Contribution to Investment %20) |

| Social Security Premium Support (Employer’s Share) | 2 years (out of OIZ) 3 years (in OIZ) |

| Land Allocation | Available |

The following sectors are granted incentive-certificates with the conditions shown below:

| No | Investment Topics | Min. Investment Amount (Million TL) |

| 1 | Refined Petroleum Products | 1.000 |

| 2 | Chemical Products | 200 |

| 3 | Harbors and Harbor Services | |

| 4 | Automotive OEM and Side Suppliers | |

| 4-a | Automotive OEM Investments | 200 |

| 4-b | Automotive Side Suppliers Investments | 50 |

| 5 | Railway and Tram Locomotives and/or Railway Cars |

50 |

| 6 | Transit Pipe Line Transportation Services | |

| 7 | Electronics | |

| 8 | Medical, High Precision and Optical Equipment | |

| 9 | Pharmaceuticals | |

| 10 | Aircraft and Space Vehicles and/or Parts | |

| 11 | Machinery (including Electrical Machines and Equipment) | |

| 12 | Integrated Metal Production |

There are two main goals of the strategic investment incentive scheme, which are to support the production of intermediate and final products with high import dependence with a view to reduce current account deficit and to encourage high-tech and high value-added investments with a potential of strengthening Turkey’s international competitiveness. Investments meeting four criteria below are supported within the frame of the Strategic Investment Incentive Scheme.

|

VAT Exemption |

Available |

|

Customs Duty Exemption |

Available |

|

Tax Reduction |

%90 (Rate of the contribution to investment 50% ) |

|

Social Security Premium Support (Employer’s Share Exemption) |

7 Years (Rate of the contribution to investment %15) |

|

Land Allocation |

Available |

|

VAT Refund |

The building and construction costs of investments of more than 500 Million TL |

|

Interest Payment Support |

Limited to 5% of total investment amount and with a cap of 50 Million TL |

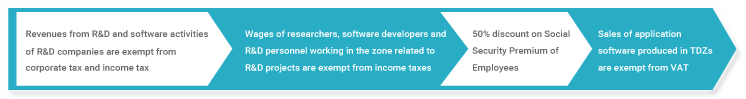

The main objectives of Technological Development Zones (TDZs), aka Technoparks, in Turkey are to produce and commercialize technological knowhow, to develop innovations in products and production methods and to create investment opportunities in high-tech industries. These zones are usually located in or around college campuses in order to boost academy-industry cooperation. Istanbul has 7 TDZs, which are Ari Teknokent of Istanbul Technical University, Yildiz Teknopark of Yildiz Technical University, Istanbul Teknokent of Istanbul University, Bosphorus Teknopark of Bosphorus University, Teknopark Istanbul of Istanbul Commerce University, Istanbul Finans Teknopark of Boğaziçi University and Marmara Teknopark of Marmara University.

Why to launch your business in TDZs?

Industrial infrastructure is at the top of Turkey’s economic development agenda. Turkish Government has taken a promoting and organizing role in industrialization instead of making industrial investments directly; and undertook investments in infrastructure and put great emphasis on energy, transportation and communication. In this context, Organized Industrial Zones (OIZs) are designed in a way that allow companies which provide goods and services to operate within approved boundaries with the necessary infrastructure, technoparks and social facilities. Basic objectives of OIZs are to allow more rational production for industrial firms that complement each other and encourage others’ production, working together under a certain program aligned with environmental regulations, to enable the relations among industries to grow easily and to establish a sound, inexpensive and reliable infrastructure and common social facilities.

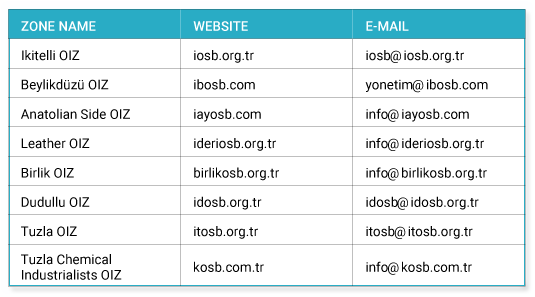

There are 2 OIZs in the European Side of Istanbul, which are Beylikdüzü OIZ and İkitelli OIZ; 6 OIZs in the Asian Side, which are Dudullu OIZ, Tuzla OIZ, Birlik OIZ, Leather OIZ, Anatolian Side OIZ and Tuzla Chemical Industrialists OIZ.

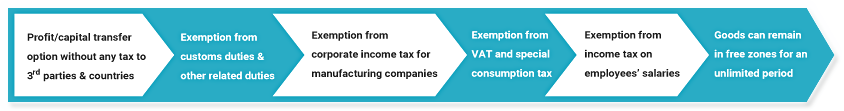

Why to launch your business in OIZs?

Turkish Free Trade Zones (FTZs) are the areas specified by the Council of Ministers of Turkey within the political borders of Turkey but considered outside the customs borders, where all types of industrial, commercial and certain types of service activities are encouraged through certain tax exemptions and incentives. The objectives of FTZs are to increase export-oriented investment and production, to accelerate the inflow of foreign capital and technology, to procure the inputs of the economy in an economic and orderly fashion, and to increase the utilization of external finance and trade possibilities. There are 3 FTZs in Istanbul; 2 in European Side (Thrace FTZ and Ataturk Airport FTZ) and 1 in Asian Side (Industry & Trade FTZ).